Log in:

> Member

HOW WE INVEST

In a changing world our top priority continues to be protecting your interests.

We position our investments to perform favourably over the long term, while seeking to protect members’ balances during periods of short-term market volatility.

For the latest information see our:

Investment updates

Watch the September 2023 investment update video

Latest investment returns for investment options

Investment FAQs

What is ANZ Staff Super doing to protect my money from market volatility?

Here at ANZ Staff Super, we focus on building diverse portfolios.

These portfolios are built to be robust over a range of market conditions and to deliver strong returns over the long term.

Our three core investment strategies are:

2. Leveraging the ‘equity risk premium’.

3. Investing at a risk level that’s appropriate for our members.

Diversification is about spreading investments across different asset classes and across different fund managers. Diversification lowers risk because different asset classes do well at different times.

Leveraging the equity risk premium

This is the belief that investors will be rewarded over the long term for the risk of investing in shares compared to very low risk investments like cash.

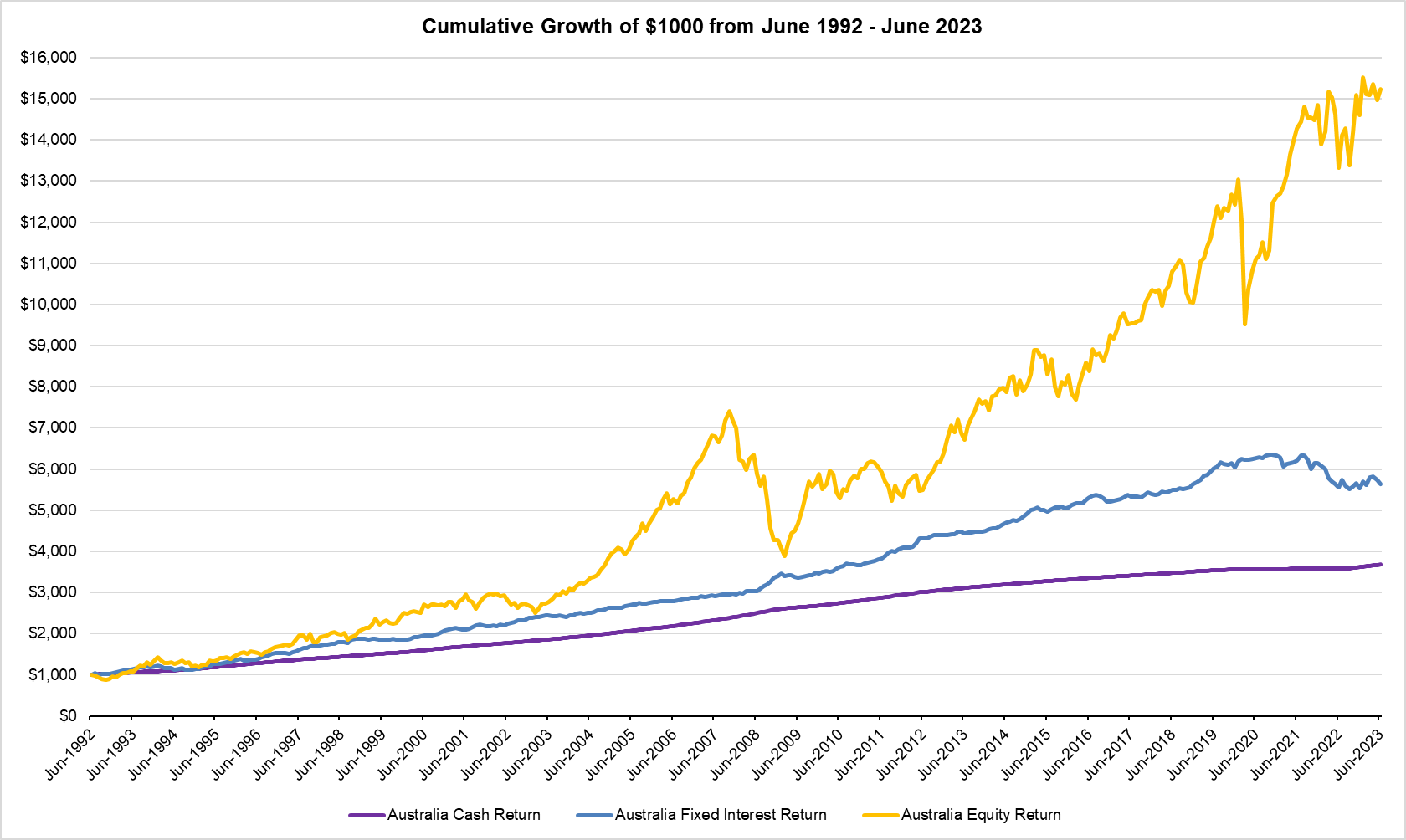

As you can see from the chart below, equities, in this case Australian equities, have outperformed other investment classes like cash or fixed interest over the long term, despite market falls along the way.

Source: WTW

It is extremely difficult to predict exactly when the stock market will go up and down.

That’s why staying invested over the long term is widely considered the best approach.

While we view equities as a key contributor to member outcomes over the long term, this does mean that falling stock markets will impact members' balances in the short term.

While the media headlines focus on market falls, ultimately the risk you face is not just short-term volatility, but the long-term risk of not having an income at retirement that meets your needs.

Investing at a risk level appropriate for our members

We believe in balancing investing for strong returns with taking an appropriate amount of risk.

The average age of an ANZ Staff Super member in our accumulation sections is 45*.

There are large funds out there with younger demographics and members who have smaller account balances. These funds tend to have a larger allocation to growth assets than us, because the investment time horizon of their members is longer. That means they can take a greater level of risk.

We’re committed to taking an appropriate amount of risk for our members, which is why our Balanced Growth option is structured the way it is. Typically around 60% of the Balanced Growth option is invested in shares and property and around 20% in alternative assets and around 20% in fixed interest securities and cash. That is our default option and where most members are invested.

*In our Accumulation sections

What steps should I take?

No one can control the markets, but you can shape your own reactions and decide what to do with your money – or, more importantly, what not to do.

One very reasonable response is to take no action at all.

If you are investing for the longer term (5 years or more) then sticking with your current investment option and riding out short-term volatility may be your best course of action.

It is a good idea to review your investment strategy from time to time. If you need help reviewing your investment strategy, we recommend you get in touch with us and get advice from an ANZ Staff Super financial adviser*.

Net zero

At ANZ Staff Super we're committed to achieving net zero carbon emissions from our investments by 2050. You can find out more here.

Get in touch

If you need help working out your investment strategy in ANZ Staff Super, call us on 1800 000 086.

Our financial advisers can provide you with general or limited personal financial advice about your options in ANZ Staff Super over the phone for no extra charge*.

*IMPORTANT INFORMATION

The Trustee of ANZ Staff Super has entered into an agreement with Mercer Financial Advice (Australia) Pty Ltd under which Mercer’s financial advisers have been engaged to provide members with general or limited personal financial advice about options available within ANZ Staff Super over the phone for no extra charge. These financial planning services are provided by Mercer Financial Advice (Australia) Pty Ltd ABN 76 153 168 293, AFSL #411766. Any advice provided by Mercer’s advisers is not provided or endorsed by the Trustee and is not provided under the Trustee’s AFSL.

Calling from Overseas: +61 3 8687 1829

8.00am - 6.00pm

Monday - Friday (AEST/AEDT)